How are Unemployment Insurance Fund (UIF) claims calculated and paid?

The Unemployment Insurance Fund (UIF) is a public entity of the Department of Employment and Labour. It was established to give short-term relief to individuals when they lose their job due to adoption, maternity, and parental leave, as well as illness. The UIF also assists by providing relief to the dependents of deceased contributors.

How are UIF benefits determined and calculated?

The Unemployment Insurance Fund (UIF) uses a specific formula to calculate the benefits received by employees.

A claim from the UIF will be dependent on the employee’s income before they become unemployed and will be determined based on a scale. The UIF claims an employee can receive will be subject to the maximum income threshold.

If an employee is earning less than the maximum income threshold, they will then be entitled to a portion of their income from the UIF. However, those earning more than the maximum income threshold will only be entitled to a percentage of the threshold amount.

How much UIF will I receive?

The income from UIF claims for employees are based on their daily rate (.i.e. earnings). The employee can claim one day’s worth of income for every six days that they have worked. This amount can accumulate to a maximum of 365 days (one year) over 4 years of continued employment. This means that if the employee has contributed to the UIF for four years, they will be able to claim benefits for 365 days (1 year.) Should the employee have contributed to the UIF for less than four years, they will then only be able to claim one day for every six days worked.

Employees can only claim from the UIF for the periods in which they are unemployed. However, should the employee already receive benefits from the Compensation funds, generate an income, or receive pension, they may then not claim any benefits from the UIF.

Read the Department of Labour’s calculation of UIF benefits here.

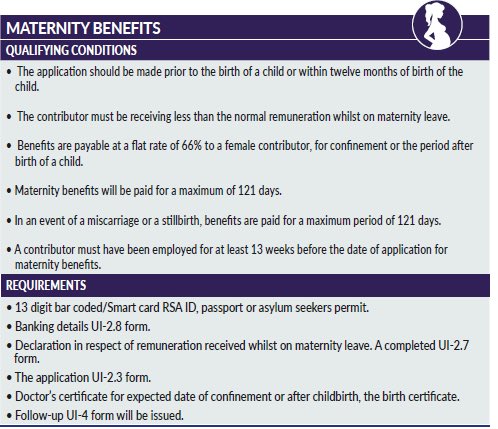

Employees can also claim from the UIF for maternity benefits. Maternity benefits can be claimed for a period of 17.32 weeks.

It is important to note that an employee will not be paid a benefit that is more than their usual income.

How is UIF paid and When?

UIF payments are made within 7 days after the end of the month in which the amount was deducted from the employee’s earnings. Should the last day for UIF payment fall on a weekend/ public holiday, the payment will then be made on the last official business day before said weekend/public holiday.

UIF payments are made using the following methods:

- eFiling

- EFTS (electronic payments made through the internet)

- At approved and relevant banking institution branches

You may want to read

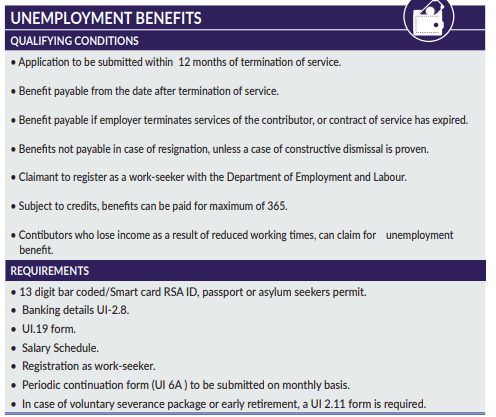

Can you claim from UIF if you have resigned?

No you can not claim from UIF if you have resigned from your workplace. UIF benefits are only applicable to employees who have been dismissed, retrenched, or if those whose contacts have expired.

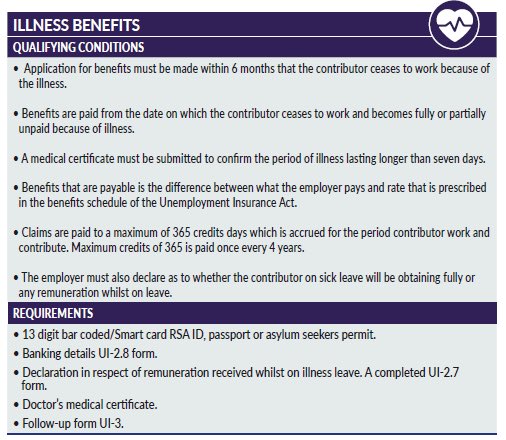

When can you claim illness benefits?

Illness benefits are applicable on employees who are off from work due to an illness or ailment. The illness must last longer than a period of two weeks in order for the employee to qualify for the benefit.

What is the maternity benefit, and how does it work?

Maternity benefits are claimed by employees who are pregnant and need to take maternity leave. Maternity leave can be taken within four weeks before the child is (expected to be) born. It is important to note that in order to qualify for the maternity benefit, the employee may not work for a period of 6 weeks after the birth of the child.

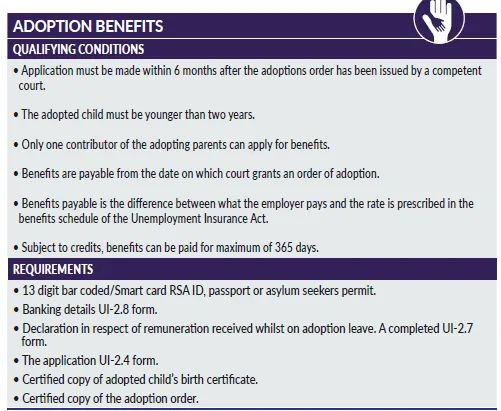

What is the adoption benefit and how does it work?

UIF adoption benefits are applicable on employees who legally adopt a child and are unable to work. The child has to be under two years old and the reason for the employee leaving work has to be to look after the child. It is important to note that only one of the adoptive parents can apply for the UIF adoption benefit.

If your spouse passes away, can you claim UIF?

If your spouse has passed away, you and/or your minor child may claim death benefits. Death benefits can only be claimed from the UIF if the deceased employee made contributions towards the fund.

How long does UIF pay out?

UIF payments can be claimed for a period of twelve months (one year) if you have full credit days. Credit accumulates as follows: for every four days you work contributing to the UIF, you will in return receive one day’s credit.

This pay-out period is limited to a maximum of twelve months (one year.)

How long will it take until you receive your UIF payment?

The time frame for UIF payments will be determined on if your application is completed correctly and if your employment history is up-to-date. Should your employment records be inaccurate and incomplete, the UIF will extend the time to finalize your claim.

READ ABOUT: Types of grants

SRD R350 Grant Care Dependency Grant Child Support Grant Foster Child Grant Disability Grant Older Persons Grant Grant-In-Aid War Veterans Grant

Types of Grants How to Apply Status Check Payment Dates Jobs & Vacancies Updates & Blog Contact SASSA

QUERIES AND CONTACT

For any further queries, please contact SASSA directly:

Contact the SASSA Toll Free Call centre on: 0800 60 10 11

Contact the SASSA Head Office on: 012 400 2322

Email SASSA Head Office at: Grantsenquiries@sassa.gov.za

Contact details of SASSA offices across the country: SASSA contact details