Unemployment Insurance Fund (UIF) – who can claim and how much can they claim

The Unemployment Insurance Fund (UIF) is a public entity of the Department of Employment and Labour. It was established to give short-term relief to individuals when they lose their job due to adoption, maternity, and parental leave, as well as illness. The UIF also assists by providing relief to the dependents of deceased contributors.

UIF contributions are made on a monthly basis. Your employer is required to register you, with both parties (employee and employer) making monthly contributions. Keep reading to find out how much of your monthly salary must be contributed to the UIF fund.

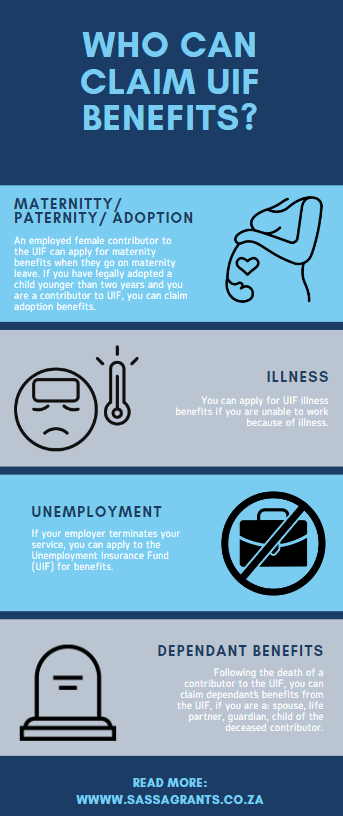

Who can claim from UIF?

Individuals can claim from UIF if:

- They become unemployed (but not if you have resigned, been suspended or absconded from work)

- They are unable to work due to maternity/ paternity leave, illness, adoption leave, or commissioning parental leave

- They have passed away and have dependents

Such individuals need to be:

- Employed/ have been employed (.i.e. an employee)

- Someone who has made monthly contributions to the UIF

- Someone who works more than 24 hours a month

The employer must have also registered the employee with the UIF and made monthly contributions.

Who can NOT claim UIF?

Individuals cannot claim UIF:

- They work less than 24 hours a month

- They are a particular member of the State

- They do not comply with the law

- They are suspended from claiming benefits from the UIF (e.g. by making false statements, not informing the UIF that they were re-employed, committing fraud, etc.)

It’s important to note that if you are a domestic worker and have more than one employer, should you lose your job with one of them you may then claim part of the benefits you would receive if you were completely unemployed.

If you are an employee who loses part of your income owing to reduced working hours, you may also claim part of the benefits you would receive if you were completely unemployed.

How much is contributed to UIF?

Both the employee and employer each contribute 1% of the employees monthly income to the UIF fund. It is the responsibility of the employer to ensure that these deductions are completed on a monthly basis. Should an employer not make the adequate deductions for the UIF payments, the employer will then be held responsible to pay the amount in full to the UIF.

All benefits paid to the employee by the UIF may not be attached in any court order, except if the attachment is based on the employee not paying maintenance to their dependents. Any benefits paid to the employee by the UIF may also be used to settle any outstanding debt (this decision will be made solely by the UIF.)

All benefits received by the employee are not taxed.

You may want to read

How much will UIF pay each month?

Each month, the employer deducts 1% of the worker’s total earnings (excluding commission) for UIF payments, and the employer contributes an additional 1%. Therefore, the total contribution paid to the UIF is 2% of the employees total earnings per month.

For example: If an employee earns R1 000 per month, the employer will deduct R10 (1%) from their earnings. The employer will then also pay R10 (1%), making the total monthly contribution of R20 (2%). That R20 will then be paid to the UIF/ SARS before the 7th day of each month.

From 1 June 2021, the maximum earnings ceiling was set at R17 712 per month (.i.e. R212 544 a year) – this means that if an employee earns this amount or more, their UIF contributions will be capped at R177.12 per month (1% of their monthly earnings).

How long can I claim UIF for?

The length of time you can claim UIF funds depends on how long you have been contributing to the UIF fund.

If you have been contributing for 4 or more years, you will be able to claim up to 238 days. The first 238 credit days will be paid according to a scale of benefits, ranging from 30 to 60% of your salary. After the 239 credit days until the 365 credit days, you will receive UIF at a fixed rate of 20% of your salary.

Employees who have been contributing for less than 4 years, you will be able to claim 1 day out of every 6 days you worked while contributing to UIF.

For example: If an employee earns R1 000 per month, their UIF payment can be calculated as follows:

1) Calculate the daily pay – mutiply the monthly salary by 12 months and then divide by 365 days (R1 000 x 12 / 365 = R32.88 per day).

2) Calculate your claim – you can claim 1 day of benefits for every 6 days you are unemployed.

So if you worked for 200 days before becoming unemployed, divide it by the 6 days and multiply it with your daily rate of pay above.

(200 / 6 = 33.3 – then 33.3 x R32.88 = R1096 will be your UIF payment)

Read the Department of Labour’s calculation of UIF benefits here.

READ ABOUT: Types of grants

SRD R350 Grant Care Dependency Grant Child Support Grant Foster Child Grant Disability Grant Older Persons Grant Grant-In-Aid War Veterans Grant

Types of Grants How to Apply Status Check Payment Dates Jobs & Vacancies Updates & Blog Contact SASSA

QUERIES AND CONTACT

For any further queries, please contact SASSA directly:

Contact the SASSA Toll Free Call centre on: 0800 60 10 11

Contact the SASSA Head Office on: 012 400 2322

Email SASSA Head Office at: Grantsenquiries@sassa.gov.za

Contact details of SASSA offices across the country: SASSA contact details